Wyoming Is Top Tier for States with the Lowest Tax Rates

Tax season is always a stressful time of year, whether you're getting a refund or paying, it can be more than a little jarring. But how does Wyoming fair when it comes to all forms taxation, from property taxes, to income taxes, to vehicle taxes?

A new study conducted by personal finance website, WalletHub, listed the "States with the Highest & Lowest Tax Rates", and the Cowboy State is right near the top for the overall lowest rate. As matter of fact, Wyoming scored at the #5 spot, with only Alaska, Delaware, Montana and Nevada respectfully scoring higher.

While it's no secret that Wyoming has no state income (which definitely helped our score), it's was not the only factor. WalletHub used a number of metrics to analyze overall scores. Below you can see how well we scored in some and how badly we scored in others:

- 5th – Overall Effective State & Local Tax Rate

- 1st – Income Tax

- 10th – Real-Estate Tax

- 41st – Vehicle Property Tax

- 39th – Sales & Excise Taxes

The WalletHub study showed some alarming nationwide numbers, which stated:

The average U.S. household pays over $10,000 in federal income taxes. And while we’re all faced with that same obligation, there is significant difference when it comes to state and local taxes. Taxpayers in the most tax-expensive states, for instance, pay three times more than those in the cheapest states.

That really puts things into perspective.

It's always great to see Wyoming getting great scores in one of these studies, but landing in the top 5 is astronomical. Way to go, Equality State!

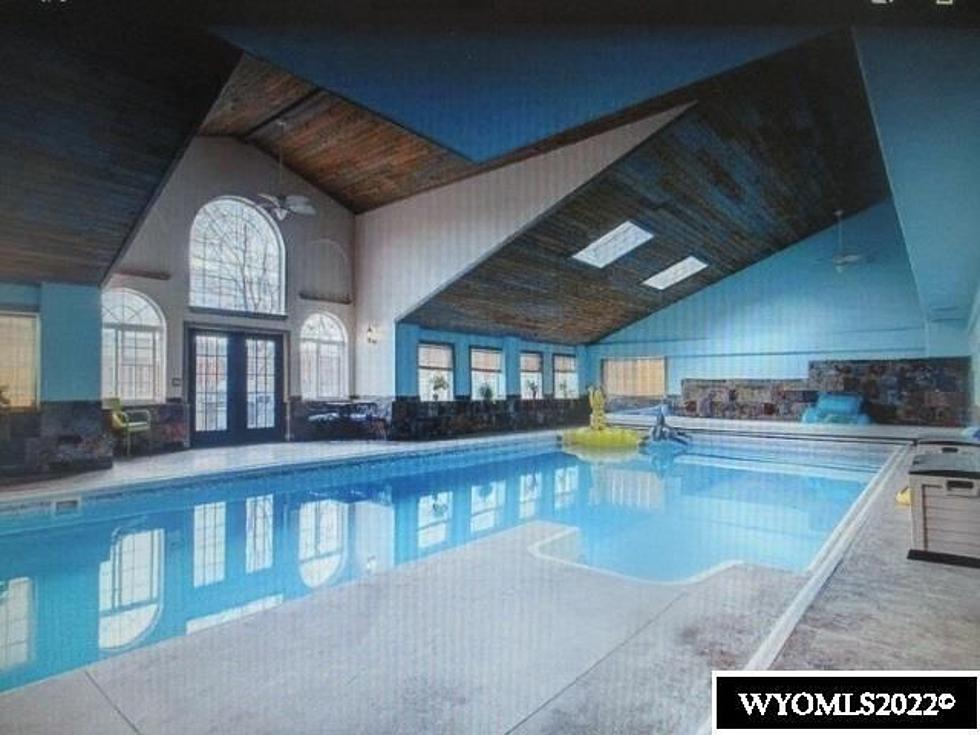

Casper Home Has Gigantic Indoor Swimming Area

The 10 Commandments of Casper, WY

More From AM 1400 The Cowboy